WSJ Reading and Analysis -2nd

本文最后更新于 2025-11-10,墨迹未干时,知识正鲜活。随着时间推移,文章部分内容可能需要重新着墨,请您谅解。Contact

Everyone’s Rattled by the Rise of DeepSeek—Except Nvidia, Which Enabled It

-Nvidia’s stock swooned and regulators are restricting its chip sales, but the American AI giant sees a long game in China

Audio

Original Text

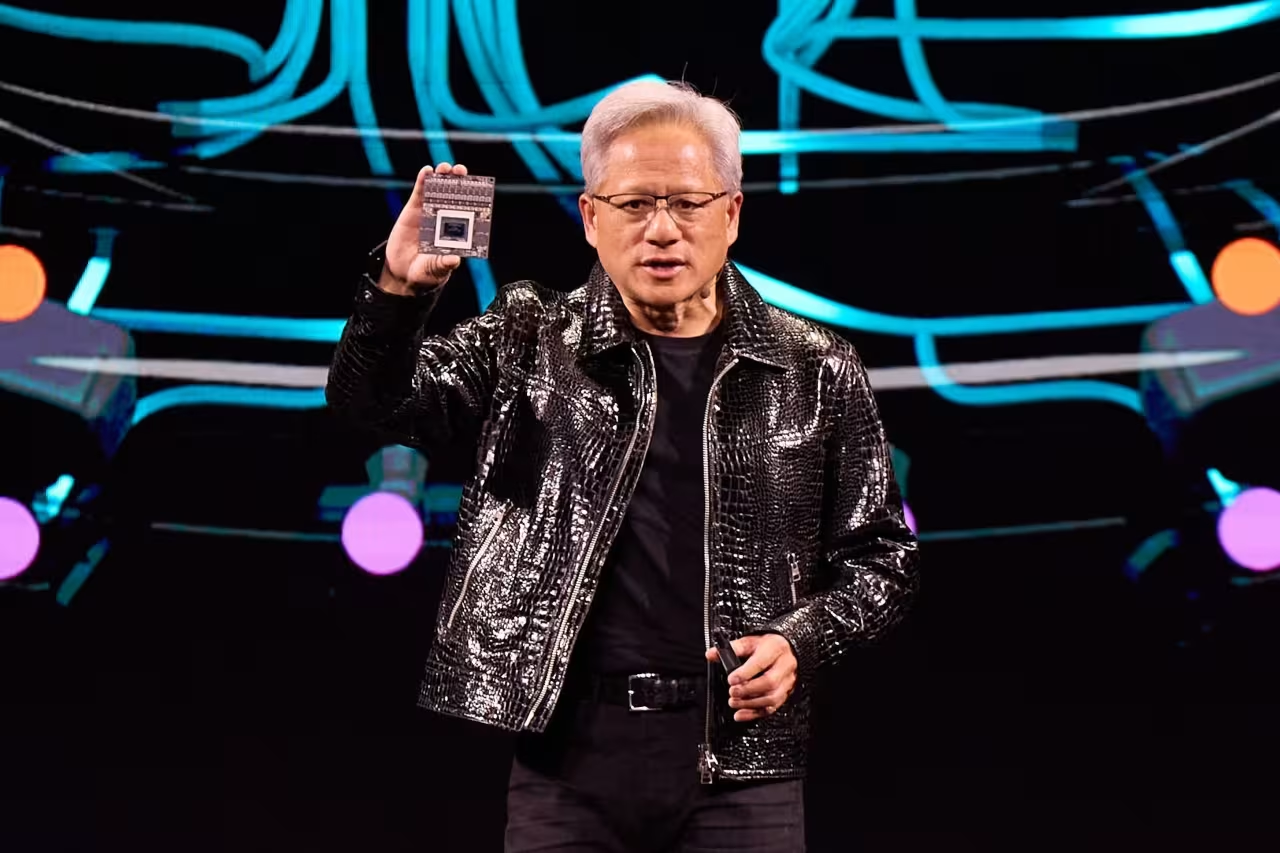

On President Trump’s inauguration day, Nvidia NVDA 2.87%increase; green up pointing triangle Chief Executive Jensen Huang wasn’t sitting by the president’s side at the Capitol like many tech moguls. He wasn’t invited, an Nvidia official said, so he had gone to Beijing.

At a gathering there, Huang told customers and employees of his strong commitment to the Chinese market, according to a recording. That meant Nvidia intended to keep selling chips for artificial intelligence in China, holding back their performance to comply with ever-tighter curbs imposed by Washington.

A week later, Nvidia’s stock price fell 17% in a single day, after Chinese company DeepSeek said it achieved a leap in its AI capabilities using less-advanced Nvidia chips. Some investors interpreted the advance as undercutting the market in the West for Nvidia’s top-of-the-line products.

Yet Nvidia knew that risk came with what it was doing in China, the country identified by both political parties in Washington as America’s biggest global rival.

The Silicon Valley company argues that selling to Chinese customers helps it bring in revenue to keep its global lead in AI. Better to have those customers paying Nvidia billions of dollars and remaining hooked on its chips—plus the software surrounding them—than to send them searching for a Chinese alternative, company officials say.

For the past three years, Nvidia, valued at around $3 trillion thanks to its dominance in AI chips, has battled to keep doing as much business as possible in China. Each time the U.S. increased restrictions on what it could sell, Nvidia rushed to design new chips that satisfied the rules but offered a competitive product—frustrating the national-security officials in Washington trying to regulate them.

Nvidia described DeepSeek’s models as further evidence of how Nvidia chips can power advances in AI, and said companies moving the industry forward would continue to need truckloads of the most advanced chips. It said DeepSeek’s advances didn’t change its view of how its chips should be regulated.

“We scrupulously adhere to all export restrictions,” Nvidia said, adding, “Our success opens doors for American industry globally.”

Huang, the Nvidia CEO, met Trump on Friday at the White House. People familiar with the discussion said the two, meeting for the first time, talked about AI policy. One person said the subject of DeepSeek came up and that Huang told the president that the public was overreacting.

Long-term market

Nvidia has urged the Trump administration to reverse restrictions put in place by the Biden administration, which further capped international sales of advanced AI chips just days before leaving office.

“America wins through innovation, competition and by sharing our technologies with the world—not by retreating behind a wall of government overreach,” said Ned Finkle, Nvidia’s vice president of government affairs.

The battle between Nvidia and its regulators gets to a fundamental question in Washington about the U.S. and China, the world’s two biggest economic powers. Is the ruling Chinese Communist Party such a threat that any substantial business ties should be dissolved? Or can the two nations continue trading in high-tech areas even as they compete for global influence?

“Our open society will always out-innovate the rigid surveillance state imposed by the CCP, but if we keep allowing the CCP to steal our ideas and technological breakthroughs, it won’t mean a damn thing in terms of staying ahead,” wrote Trump’s national security adviser, Michael Waltz, in a book published last year.

Trump’s pick for commerce secretary, Howard Lutnick, said at a confirmation hearing Wednesday that he doesn’t want American technology aiding innovation in China. “Nvidia’s chips,” he said in the hearing, “drive their DeepSeek model. It’s got to end.”

For Nvidia, the fight is less about sales in the short term. In the four quarters that ended in October, Nvidia had $113 billion in sales, with about 12% from China. Those China sales could easily be replaced elsewhere because of high demand.

Nvidia’s thinking is long-term: It believes China will be an important market for years to come. As the world’s pre-eminent manufacturing powerhouse, the country is likely to be among the leaders in AI-related areas such as robotics and autonomous driving. People at Nvidia said the company needs to do business there to stay relevant, especially as AI functions are incorporated into everyday devices that are often made in China.

Part of Nvidia’s dedication to its China business is shown by its work to keep its 4,000 employees there, who are coveted by rivals.

Xie Weide, a headhunter in China, said some companies were offering Nvidia engineers and marketing managers double their current salaries. For months, Xie said he has spent lunchtime at a coffee shop near Nvidia’s Shanghai office, approaching staff to recruit them for Huawei and another Chinese company.

At the recent Beijing gathering, Nvidia’s Huang boasted that Nvidia’s annual employee turnover in China was just 0.9%, less than Nvidia’s global average of 2%.

“Once you join Nvidia, you don’t leave,” Huang said. “If you join Nvidia, you’re going to grow old with me.”

The CEO toured several Chinese cities to celebrate the Lunar New Year, attending staff parties where he danced to the latest pop hits. He met robot startups using AI technology that have been praised in state media.

“Together over the last two decades, we have contributed to the modernization of one of the greatest markets, the greatest countries in the world,” Huang told his Chinese audience. “And we’re extremely proud to be a part of your ecosystem.”

Cat-and-mouse game

The battle between Nvidia and the U.S. officials trying to regulate its China business began in earnest in late 2022, around the same time OpenAI’s chatbot ChatGPT kicked off the AI frenzy. Nvidia had the best chips to train AI models, and all the top players—OpenAI, Google, Amazon, Microsoft, Meta and more—clamored for as many as they could get.

Since late 2022, Nvidia’s shares have increased 10 times, from roughly $12 a share to about $120 a share now, and the company has at times been the world’s most valuable by market capitalization.

Chinese companies wanted to be in the vanguard of AI, too, especially DeepSeek, then a virtually unknown research unit inside a Chinese hedge-fund operator. In a presentation for an Nvidia conference in March 2022, an executive at the hedge fund described how it had amassed 10,000 of Nvidia’s then-cutting-edge A100 chips. The company was the first in China to put together a server with those AI chips, he said.

The Biden administration wanted to restrict China’s access to the technology, recognizing that AI was sure to have military applications, such as guiding a smart drone to identify the best target. With tensions rising over Taiwan, the U.S. didn’t want Beijing to gain an edge in a conflict.

In October 2022, it put in place the first export controls specifically targeting AI chips, including the A100s DeepSeek had bought—setting off a cat-and-mouse game of regulations to limit the spread of the chips.

Nvidia’s engineers soon rolled out a chip called A800—a variant of the A100 that met U.S. rules and that Nvidia would effectively sell only within China. The development came at breakneck speed for an industry where new chips often take years.

Nvidia then developed another chip, the H800, an adaptation for the Chinese market of the company’s next-generation H100 AI chips, which were also effectively banned for export to China.

The new chips complied with Washington’s limits but used workarounds elsewhere that enabled them to be almost on par with its top products at the time, analysts said.

China’s biggest tech companies, including TikTok parent ByteDance, have placed billions of dollars of orders for the chips Nvidia designed specifically for China. DeepSeek said in a research paper in December that it used around 2,000 H800s to train a model behind its chatbot.

Nvidia’s strategy to sell modified chips angered U.S. officials, who were upset the company wasn’t being more helpful to curb China’s AI advances. They thought Nvidia wasn’t acting in the spirit of the rules, while the company said it was following them as written.

“That’s not productive,” said then-Commerce Secretary Gina Raimondo in December 2023. “Our national security goal is to have no AI special sauce in your chips.” Later that month, she toned down her criticism, calling Nvidia a good citizen and saying it was important to allow the company to continue to compete in the world.

The U.S. put in new controls in October 2023 that required a license for Nvidia’s China-specific A800 and H800 chips. Again, Nvidia developed a new batch of chips that complied with the controls, including a model called the H20.

Battle over latest chip

While Chinese customers initially were concerned about the repeated downgrades in Nvidia’s chips, it became apparent by last year that the H20 was still plenty powerful for AI tasks, said people involved in the China AI business. Chinese rivals such as Huawei struggled to produce chips that could compete with Nvidia’s in sufficient quantities.

Nvidia had stuffed into its chip package an additional AI-oriented memory unit to augment the H20’s capabilities, the people said. Thanks to the improvement, the H20 for China actually outperformed Nvidia’s H800 chip in certain scenarios, even though it had to comply with new U.S. restrictions, they said.

Meanwhile, Chinese customers who weren’t satisfied with the H20 found ways to get more advanced Nvidia chips by accessing computing power remotely or bringing the chips to China via third countries.

Eventually, DeepSeek was likely able to amass an estimated 50,000 Nvidia chips, a mix of H800s, H20s and the banned H100s, according to supply-chain data compiled by Dylan Patel, the founder of industry analysis firm SemiAnalysis.

OpenAI said it was investigating whether DeepSeek used its models to train its chatbot.

Nvidia said it believes it didn’t take a lot of chips for DeepSeek to accomplish what it did, and that instead it only needed smart engineers and access to OpenAI’s advanced models to help it create a competitor. It said it saw DeepSeek as an inevitable “fast follower.”

DeepSeek didn’t respond to requests for comment.

Biden administration officials could see what was happening, but they often disagreed on what to do about it. Officials sympathetic to companies that sell abroad squared off with national-security hawks who feared China would beat the U.S. in the AI war.

Some officials wanted to crack down on Nvidia’s China business and do it quickly, according to people familiar with the discussions. But actions were sometimes delayed because other officials were sensitive to the risk of hitting revenue at Nvidia and other big American companies.

Toward the end of the Biden administration, White House and Commerce Department officials discussed putting controls on Nvidia’s H20 chips as they realized their growing value to how AI is developed, according to people familiar with the matter.

Ultimately, the officials couldn’t agree on whether to implement a ban before time ran out.

People who know Huang, the Nvidia founder, describe him as a businessman who loves making and selling cutting-edge tech products and doesn’t enjoy getting mixed up in government policy debates. The Taiwan-born CEO, who grew up in the U.S. and is a U.S. citizen, didn’t keep a serious government-relations office in Washington until after the export-control battle flared up.

Nvidia and the Biden administration generally kept their relationship civil in public, but the gloves came off after the November election. The administration was preparing a final sally of measures adding curbs on the sale of chips to third countries that could serve as conduits to China.

As drafts of the rules circulated in Washington, Nvidia summoned some of the biggest tech names for a December meeting at which Nvidia urged them to lobby against the rules, said people familiar with the meeting. The chip maker argued that adding red tape on sales to most countries around the globe would hobble the entire industry and hurt America’s competitiveness.

Some, including Oracle, joined Nvidia in making that case to the U.S. The new rules moved forward anyway.

In recent weeks, Nvidia sales staff have told Chinese customers that the H20 chips would remain available in China because the latest Biden curbs don’t ban them.

Some members of Congress are now advocating such a ban. In a letter released Thursday, leaders of the House Select Committee on the Chinese Communist Party called for tighter controls on Nvidia, including a possible H20 ban. The lawmakers said DeepSeek’s extensive use of Nvidia chips shows that “frequently updating export controls is imperative.”

The decision will ultimately be up to Trump, whose administration also contains both China hawks and people more sensitive to the business imperatives of American exporters such as Nvidia.

Some Chinese tech executives said they were concerned about losing access to H20s because they don’t have immediate substitutes—echoing a remark by DeepSeek founder Liang Wenfeng last year that his biggest problem wasn’t finding funds but obtaining advanced chips.

At the same time, the executives said Chinese companies were again looking at workarounds, such as moving computing-intensive tasks overseas where Nvidia chips are easier to get.

China is pushing to keep its companies’ access to Nvidia chips while urging them to find Chinese alternatives wherever possible, according to the executives. In December, Chinese regulators said Nvidia might have violated local antitrust laws, in a move interpreted as a warning that Beijing, too, has cards to play if Washington gets tough.

——Amrith Ramkumar, Dustin Volz and Liza Lin contributed to this article.

Analysis

1. Nvidia's Strategic Positioning and the Chinese Market

1.1 Commitment to the Chinese Market

Despite U.S. restrictions on AI chip sales, Nvidia remains determined to maintain its presence in China. Recognizing China's position as a global manufacturing leader, Nvidia sees significant market potential in AI-related domains such as robotics and autonomous driving. Staying active in the Chinese market is viewed as essential to maintaining its leadership in the AI sector globally.

1.2 Product Adaptation to Meet Export Controls

To comply with U.S. regulations on high-end AI chip exports, Nvidia swiftly developed chips like the A800 and H800, which meet regulatory requirements while delivering performance close to their top-tier products. Nvidia has even designed the H20 chip specifically for the Chinese market. This adaptive product strategy enables Nvidia to continue serving Chinese customers while adhering to U.S. export restrictions.

1.3 Retaining Talent and Competitive Edge

Nvidia is making significant efforts to retain its 4,000 employees in China, thereby preventing them from being poached by competitors such as Huawei. This underscores Nvidia's recognition of the importance of the Chinese market and its commitment to long-term investment in the region.

2. Rise of DeepSeek and Market Reactions

2.1 DeepSeek's Technological Advances

DeepSeek utilized relatively mid-tier Nvidia chips to achieve breakthroughs in AI capabilities. This achievement caused Nvidia's stock to plummet upon announcement, reflecting market concerns about the potential threat posed by Chinese companies leveraging Nvidia's chips to achieve technological milestones.

2.2 Nvidia's Perspective

Nvidia views DeepSeek's success as evidence of its chips' critical role in advancing AI. The company insists that the demand for advanced chips will remain robust. It also emphasizes that DeepSeek's progress is primarily due to the ingenuity of its engineers and access to advanced models from companies like OpenAI, rather than any unique qualities of Nvidia's chips alone.

3. U.S. Regulatory Landscape and Nvidia's Response

3.1 U.S. Export Control Policies

The U.S. has introduced a series of export restrictions, particularly during the Biden administration, aimed at limiting China's advancements in AI for military and technological applications. These restrictions have compelled Nvidia to continually adapt its product offerings to comply with changing rules.

3.2 Nvidia's Lobbying Efforts and Policy Challenges

Nvidia has partnered with industry leaders to lobby against further export restrictions, arguing that such measures would stifle the broader technology industry's growth and harm U.S. competitiveness. While some stakeholders support Nvidia's stance, new regulations have been implemented regardless, reflecting the U.S. government's broader strategy to curb China's technological progress.

3.3 Tensions in Government Relations

Publicly, Nvidia maintains a relatively cordial relationship with U.S. regulators. However, tensions escalate during periods of regulatory change, particularly around key political events such as elections. Nvidia's ability to navigate these challenges demonstrates its flexibility, though it remains vulnerable to the risk of further restrictions.

4. Future Outlook and Potential Implications

4.1 Long-Term Market Strategy

Nvidia remains confident that the Chinese market will continue to be a critical player in its global strategy. By maintaining investment and adaptive measures, Nvidia aims to retain its leadership in AI globally. However, intensifying U.S.-China technology competition poses continuous risks and challenges.

4.2 Shift in Competitive Landscape

The success of companies like DeepSeek in leveraging Nvidia chips illustrates that Chinese firms possess considerable capacity for innovation, even under export restrictions. As a result, Nvidia and other U.S. companies may need to further enhance their technological advantages to remain competitive in this increasingly dynamic market.

4.3 Interaction Between Policy and Corporate Strategies

Changes in U.S. policy have a direct impact on Nvidia's strategic decisions. To sustain its competitive edge, Nvidia must maintain open lines of communication with regulatory bodies while continuing to adjust its product and market strategies to meet evolving policy requirements and global demand.

4.4 Global Supply Chain and Tech Ecosystem

To maintain its technological ecosystem and leadership, Nvidia is fine-tuning its chip designs and supply chains on a global scale. However, ongoing uncertainties in global political and economic conditions could pose risks to supply chain stability and technological expansion.