Economist Reading and Analysis -4th

本文最后更新于 2025-11-10,墨迹未干时,知识正鲜活。随着时间推移,文章部分内容可能需要重新着墨,请您谅解。Contact

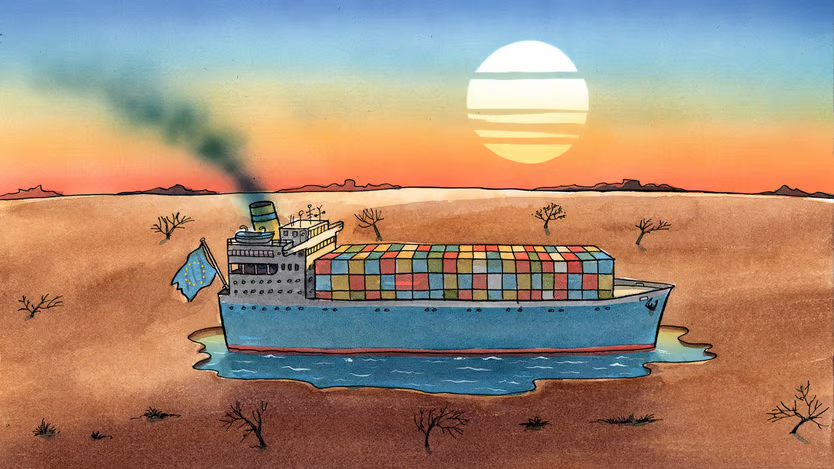

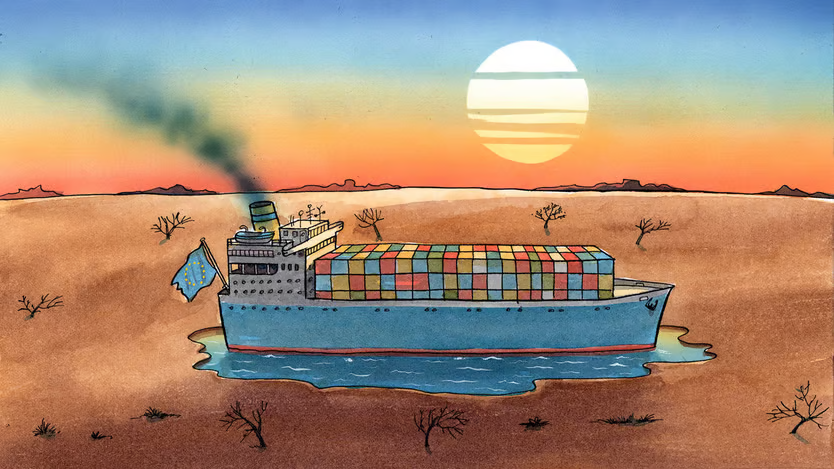

Can Europe afford to be the world’s last free-trader?

-The EU tries to navigate a global trade spat

Audio

Original Text

The European Union seems an unorthodox champion of free trade. Beyond a few purveyors of handbags and slimming drugs, few of its big companies compete successfully with rivals from America and China, the world’s two biggest economies. Negotiating a trade agreement with the EU means that countries halfway across the world have to sulkily accept that champagne can come only from the northern region of France or feta cheese from Greece. Back in Europe, the merest hint of a free-trade deal causes farmers from across the continent to descend on Brussels and pummel Eurocrats with eggs and manure.

Despite all this, the EU is what passes for a free-trade enthusiast these days—if only by default. America, which built the global free-trading system alongside Europe in the decades after the second world war, is now run by a president who adores tariffs almost as much as he does gaudy skyscrapers. China is no better. Though it got rich in part through its exporting prowess, it continues to lard favoured companies with subsidies, against the spirit of free-trade rules; this week it imposed retaliatory tariffs on American goods. Plenty of smaller economies, from Costa Rica to Japan, remain committed to the strictures of the World Trade Organisation. But of the world’s three major economic blocs, the EU is the only one that could plausibly hide behind trade barricades—leaving its firms serving a market of over 400m mostly rich consumers—but has so far decided not to. Being in this major-open-economy club of one sets nerves jangling among some politicians. Is the EU naive to follow global rules others ditched long ago? Can Europe afford to remain the world’s last free-trader?

The short answer is that it may have no choice. Donald Trump’s bluster on trade is concerning for Europe precisely because international commerce matters to it so much. For despite an enduring bout of economic anaemia, the EU is an importing and exporting powerhouse. Its 27 countries sell more goods to foreigners than anyone bar China, and are behind only America when it comes to buying them in. Despite its smaller economy, the EU out-trades America in absolute terms. It sends and receives goods from outside the bloc worth 29% of GDP, compared with 19% for America. The surplus of trade beyond the club’s borders is vital for the European economy, not least given that its own consumers (and many governments) are hard-up. “Europe has been relying on exports more than other regions,” points out Brad Setser of the Council on Foreign Relations, an American think-tank.

Two prospects haunt the EU. The first is an inescapable trade tiff with Mr Trump, who calls the EU an “atrocity” on trade and has promised to impose his beloved tariffs, as he did in his first term. Assuming the threat is enacted, this would throttle Europe’s exports to its biggest market just as its economy is in the doldrums. The second fear is how China will react to finding itself on the sharp end of American protectionism. With its own biggest foreign market increasingly restricted, China might divert goods to the still-open EU so as to keep its factories humming. Though consumers would benefit from cheap wares, European firms making cars, dishwashers and the like there would suffer. Politicians are unlikely to tolerate this; a surge in Chinese electric vehicles (EVs) heading to the EU last year prompted the bloc to impose tariffs of around 35%, purportedly to offset the advantage Chinese firms get from state subsidies.

Such fretting over slumping exports and surging imports comes on top of a growing scepticism in some EU quarters of the benefits of free trade. These days it is not only European farmers who complain about imports. “Trade used to be about economics; now it is also about geopolitics,” says Jacob Kirkegaard at Bruegel, a think-tank in Brussels. Globe-spanning supply chains were once seen as clever business. Now politicians worry more about economic security, and becoming hooked on stuff produced by potential foes (Russian gas comes to mind). France, long sceptical of overly-open trade, has pushed the idea of “strategic autonomy”, meaning reducing reliance on foreigners. Germany used to be keen on trade with China when that meant shipping lots of cars there; less so now that Chinese rivals build world-beating EVs. The EU has also gummed up international trade by insisting its partners must espouse Euro-regulatory norms as a condition of trade: countries exporting steel made with planet-warming coal, for example, will soon have to pay into a “carbon border adjustment mechanism”.

Trading places

Luckily for free-traders, France’s influence in Europe has atrophied as its politics has descended into chaos. And there are still lots of fans of open commerce in Europe, notably among its smaller countries, from Denmark to the Czech Republic and Ireland. Their firms have long thrived by looking beyond puny domestic markets: there are only so many potential Danish customers for Ozempic, a fat-busting drug invented there. Bringing down trade barriers is enshrined in the EU’s founding treaties, points out Cecilia Malmstrom, a former trade commissioner for the bloc.

With no choice but to keep trading, what are Europe’s options? One solution is to find a balance between China and America. EU officials have suggested the bloc should help America contain the “challenge” of Chinese exports, or conversely seek ways of expanding its trade with China (final outcome: to be confirmed). Meanwhile the bloc has signed or initiated a slew of bilateral trade arrangements with smaller partners in recent months, including Mexico, Malaysia and Mercosur, a bloc that includes Brazil and Argentina. More such deals are in the works, to farmers’ irritation. But if the two giants of the global economy step back from free trade, Europe will need new partners.

Analysis

EU's Position in Global Trade

Traditionally, the EU has positioned itself as a staunch advocate of free trade, seeking to maintain open markets and reduce trade barriers. This stance is enshrined in its foundational treaties, which emphasize the lowering of tariffs and the promotion of seamless commerce among member states and with external partners. However, the article highlights that this idealism stands in contrast to the practical competitiveness of European industries. While sectors like luxury goods (e.g., handbags) and pharmaceuticals (e.g., slimming drugs) thrive, many major EU companies lag behind their American and Chinese counterparts.

Challenges from the United States and China

-

United States: The article points out that the current U.S. administration under President Donald Trump has exhibited a proclivity for protectionism, reintroducing tariffs that threaten to stifle EU exports to one of its largest markets. This is particularly concerning given the EU's significant reliance on exports, which constitute 29% of its GDP compared to the U.S.'s 19%. Such tariffs could exacerbate the EU's economic struggles, reducing its export surplus and impacting industries already under pressure.

-

China: China's strategy has been dual-faceted—leveraging its export prowess to fuel economic growth while simultaneously employing subsidies to fortify favored domestic companies. The imposition of retaliatory tariffs on American goods underscores China's willingness to engage in trade conflicts, potentially redirecting surplus exports towards the EU. While this might benefit European consumers through lower prices, it poses a threat to local manufacturers, particularly in sectors like automotive and household appliances. The EU's response, including imposing tariffs on Chinese electric vehicles (EVs), reflects the delicate balancing act required to protect domestic industries without abandoning free-trade principles.

Internal EU Dynamics and Protectionism

Beyond external pressures, the EU grapples with internal dissent regarding the benefits of free trade. Several factors contribute to this growing skepticism:

-

Economic Security Concerns: The collapse of global supply chains due to geopolitical tensions has shifted political priorities towards economic security. Dependencies on critical imports, such as Russian gas, have made policymakers wary of over-reliance on potentially adversarial nations.

-

Strategic Autonomy: Countries like France advocate for reducing dependence on foreign suppliers, promoting the idea of "strategic autonomy." This involves fostering domestic industries and limiting reliance on imports, which can be at odds with free-trade ideals.

-

Regulatory Standards: The EU's insistence on exporting partners adhering to its stringent regulatory norms (e.g., carbon border adjustments) introduces additional barriers. While these measures aim to uphold environmental and quality standards, they can complicate trade relationships and invite retaliation.

Balancing Act: Navigating Between Giants

The EU's predicament is further complicated by its position as a major open economy that cannot easily withdraw from the global trading system without significant repercussions. The article suggests that Europe may need to:

-

Find a Middle Ground: Collaborate with the U.S. to counterbalance China's growing influence in global trade. This could involve coordinated efforts to address unfair trade practices and promote shared standards.

-

Diversify Trade Partnerships: Engage with smaller economies and regions, such as Mexico, Malaysia, and Mercosur members (Brazil and Argentina), to build a more resilient and diversified trade network. While these efforts may alleviate some dependency on superpowers, they also require navigating new bilateral agreements and potential pushback from domestic stakeholders.

Implications for the Future

The EU's commitment to being the "last free-trader" carries both opportunities and risks:

-

Opportunities: Maintaining a free-trade stance can position the EU as a stable and reliable trading partner, attracting countries and businesses that value open markets. It also supports economic growth through access to a vast consumer base of over 400 million affluent individuals.

-

Risks: Persistent adherence to free trade in the face of rising protectionism could lead to diminished competitiveness, especially if the EU fails to innovate or protect key industries. Additionally, internal pressures and political fragmentation may undermine cohesive trade policies, weakening the bloc's negotiating power on the global stage.